Make Billionaires Pay Act

Over and over again, we have been told that we cannot possibly afford to guarantee healthcare as a right by moving to a Medicare for All system – even on a temporary basis during the worst public health emergency in over a hundred years. Well, it turns out that is not quite accurate.

While a record-breaking 5.4 million Americans recently lost their health insurance, 467 billionaires in our country increased their wealth by an estimated $731.8 billion during the pandemic. Incredibly, as a result of the Trump tax giveaway to the rich, these billionaires currently pay a lower effective tax rate than teachers or truck drivers.

According to Americans for Tax Fairness and Institute for Policy, if we taxed 60 percent of the windfall gains these billionaires made from March 18th until August 5th we could raise $421.7 billion. That’s enough revenue to allow Medicare to pay all of the out-of-pocket healthcare expenses for everyone in America over the next 12 months (based on an estimate from the Committee for a Responsible Federal Budget).

Yes, that’s right. By taxing 60 percent of the wealth gains made by just 467 billionaires during this horrific pandemic, we could guarantee healthcare as a right for an entire year. And billionaires would still be able to pocket more than $310.1 billion in wealth gains during the worst economic downturn since the Great Depression.

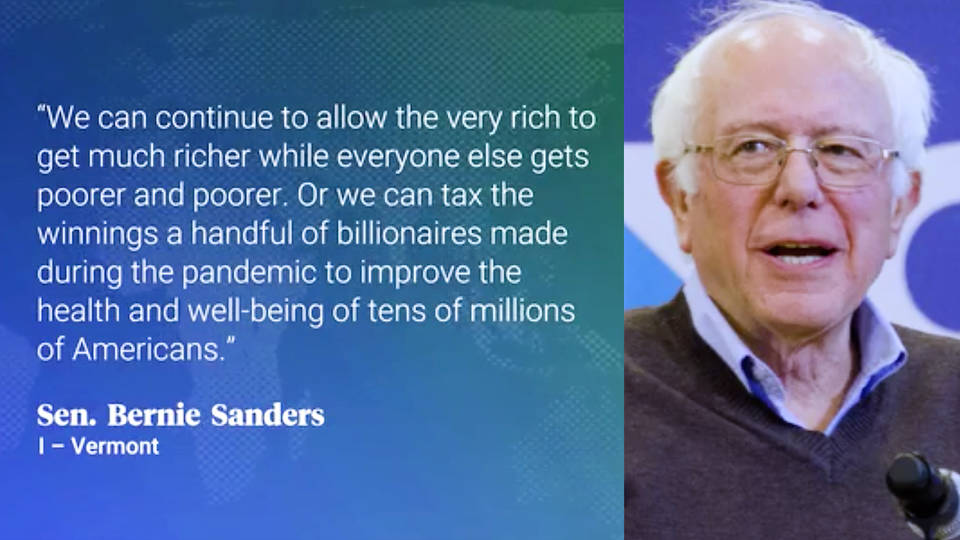

At a time of massive wealth and income inequality, when so many our people are hurting, it is time to fundamentally change our national priorities. Instead of more tax breaks for the rich while more Americans die because they cannot afford to go to a doctor, let us expand Medicare and save lives by demanding that billionaires pay their fair share of taxes.

This legislation would:

- Establish a 60% tax on the gains in wealth billionaires made between March 18th, 2020 and January 1, 2021.

- Empower Medicare to pay for the out-of-pocket healthcare expenses of all Americans for one year.

Importantly, no one who has a net worth of less than $1 billion would pay a penny more in taxes. Here are just a few examples of how much billionaires would pay in taxes under this legislation:

- Jeff Bezos, whose wealth has gone up by 63% or $71.3 billion during the pandemic, would pay a one-time wealth tax of $42.8 billion.

- Elon Musk, whose wealth has nearly tripled during the pandemic from $24.6 billion to $70.5 billion, would pay a one-time wealth tax of $27.5 billion.

- Mark Zuckerberg, who is now worth $92.7 billion, up from $54.7 billion, would pay a one-time wealth tax of $22.8 billion.

- The Walton family, the wealthiest family in America, has seen their wealth grow by $21.5 billion would pay a one-time wealth tax of $12.9 billion.

Speak Your Mind